Stunning Info About What Is The Formula For Calculating MRP

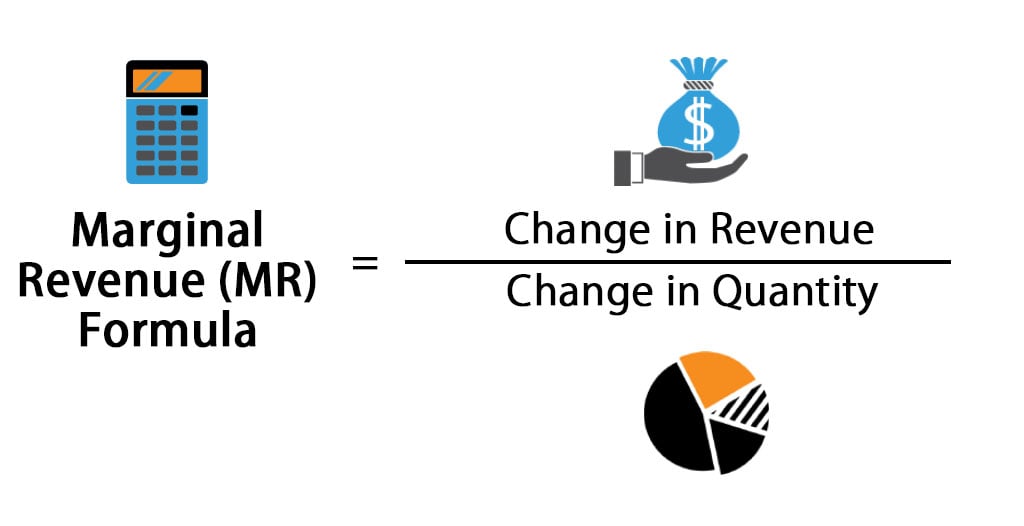

Revenue Formula

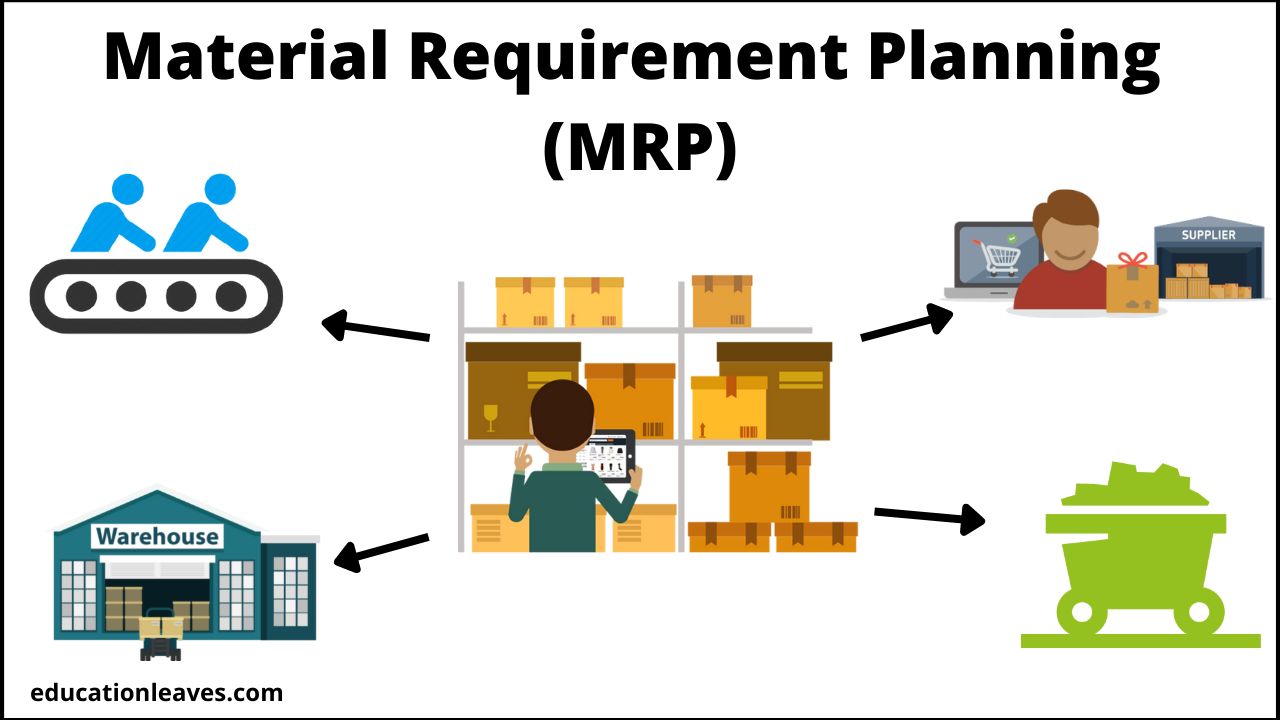

Understanding MRP

1. Decoding the Mystery of MRP

Ever stared at a product in a store and wondered, "Where does that price come from?" That little number, often printed boldly on packaging, is the Maximum Retail Price, or MRP. But how is it actually calculated? It's not some random figure pulled out of thin air, although sometimes it might feel like it! The formula for calculating MRP is actually a combination of factors, each playing a crucial role in determining what you ultimately pay.

Thinking about MRP reminds me of my first job. I was stocking shelves, and I remember accidentally smudging the MRP on a box of cookies. My manager, bless her soul, nearly had a heart attack! That's when I realized how important this seemingly small detail was. Understanding what goes into calculating the MRP can really change how you perceive the value of a product.

So, let's dive in. The MRP isn't just about the cost of making something. It encompasses a whole ecosystem of expenses. From the raw materials that go into creating the product to the transportation costs of getting it to your local store, and even the profits that manufacturers and retailers need to stay in business, everything is factored in. Think of it as a grand equation with many variables.

Basically, the MRP formula serves as the ceiling price. Retailers aren't allowed to sell a product for more than its MRP. However, they can sell it for less! That's where discounts and deals come into play, which is always a win for us, the consumers! But before we go into detail of the formula for calculating MRP, let's define the keyword term that we will use in this article, MRP, which is a noun.

Breaking Down the MRP Calculation Formula

2. The Core Components of MRP

Okay, let's get down to the numbers! While there isn't one single, universally mandated formula for calculating MRP (it can vary slightly depending on the industry and local regulations), the basic structure usually looks something like this:

MRP = Manufacturing Cost + Packaging Cost + Transportation Cost + Marketing Cost + Profit Margin + Taxes + Other ExpensesEach of these elements contributes to the final price you see on the product. Let's dissect each one. The Manufacturing Cost is pretty self-explanatory its the cost of all the raw materials, labor, and overhead involved in producing the item. Packaging Cost includes everything related to containing and protecting the product, from the box itself to the labels and inserts. Transportation Cost is the expense of moving the product from the factory to the distributor and then to the retailer. Imagine the fuel costs alone for a product traveling across the country!

Marketing Cost covers all the advertising and promotional activities used to create awareness and demand for the product. This can range from TV commercials to online ads to in-store displays. Profit Margin is the percentage of revenue that the manufacturer and retailer aim to keep as profit. This is crucial for their businesses to remain sustainable. Then comes Taxes, which are government levies that add to the final cost. These taxes can vary depending on the location and the type of product. Finally, Other Expenses cover any miscellaneous costs that don't fall into the other categories, like insurance, warehousing, or even the cost of regulatory compliance.

Understanding each of these components gives you a much clearer picture of what you're actually paying for when you buy something. It's not just the product itself; it's the entire journey that product takes to reach your hands. And, let's be honest, sometimes that journey is more expensive than the product itself!

![[Basics Of Supply Chain] Calculating MRP? R/HomeworkHelp [Basics Of Supply Chain] Calculating MRP? R/HomeworkHelp](https://preview.redd.it/basics-of-supply-chain-calculating-mrp-v0-m9yq0xxxv8ha1.png?width=1644&format=png&auto=webp&s=f8d4cf38fc1c982e3c84b19606b39f2cfef15f93)

The Impact of Government Regulations and Taxes

3. Navigating the Tax Labyrinth

Speaking of taxes, they play a significant role in the MRP calculation. Different countries and even different states or provinces within a country can have varying tax structures. This means that the same product might have a different MRP in different locations, simply due to differences in tax rates.

For example, Value Added Tax (VAT) or Goods and Services Tax (GST) are common forms of consumption tax that are often included in the MRP. These taxes are usually calculated as a percentage of the product's value, and they can significantly impact the final price. Think of it as an extra layer on top of all the other costs.

Moreover, government regulations can also influence the MRP. For example, regulations related to environmental protection or safety standards might require manufacturers to incur additional costs, which are then factored into the MRP. These regulations are often in place to protect consumers and the environment, but they inevitably add to the price of goods.

It's a complex web of rules and regulations that manufacturers have to navigate. Keeping track of all these factors and ensuring compliance can be a real headache. But it's all part of the process of bringing a product to market and ensuring that it's priced fairly and responsibly (well, hopefully!).

Manufacturer vs. Retailer

4. The Power Dynamics of Pricing

So, who ultimately decides what the MRP will be? Is it the manufacturer who makes the product, or the retailer who sells it? The answer is usually a combination of both, although the manufacturer typically has the most influence in setting the initial MRP.

Manufacturers consider all the factors we discussed earlier manufacturing costs, packaging, transportation, marketing, taxes, and profit margins and then propose an MRP to the retailers. However, retailers also have a say in the matter. They know their customers and their local market conditions, so they can negotiate with manufacturers to adjust the MRP to a level that they believe will be competitive and profitable.

Sometimes, retailers might even choose to sell a product for less than the MRP, especially if they're running a promotion or trying to clear out inventory. This is why you often see discounts and deals in stores. But they can't legally sell it for more than the MRP. It's a sort of check and balance system between the manufacturers and retailers.

The relationship between manufacturers and retailers is a delicate dance. They both need each other to succeed, but they also have their own interests and priorities. Setting the MRP is a key part of that dance, and it requires careful negotiation and compromise. It's a business ballet!

Real-World Examples of MRP Calculation

5. From Electronics to Edibles

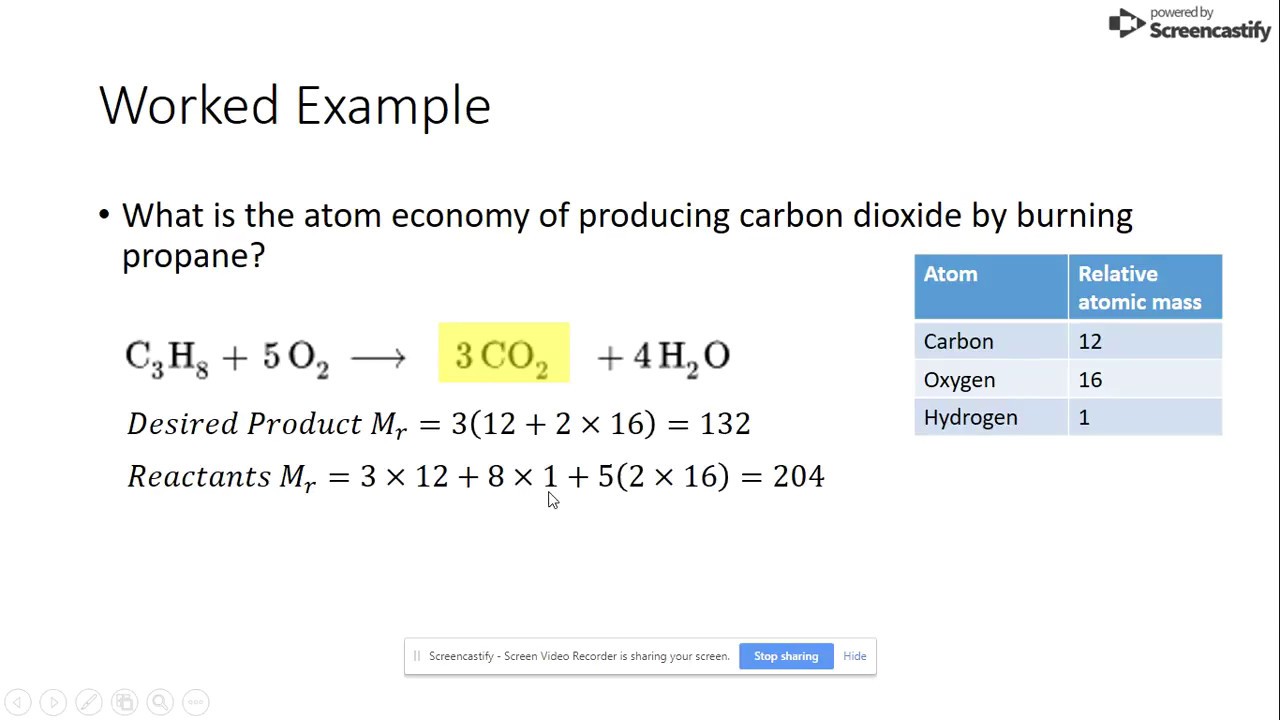

Let's look at some real-world examples to see how the MRP calculation plays out in different industries. Take, for instance, a smartphone. The manufacturing cost includes the cost of the components (screen, processor, memory, etc.), the labor to assemble the phone, and the cost of the factory where it's made. The packaging cost includes the box, the charging cable, and the user manual. The transportation cost covers shipping the phones from the factory to distributors and then to retail stores. The marketing cost includes advertising campaigns and sponsorships.

Add to that the taxes imposed by the government and the profit margins that the manufacturer and retailer want to make, and you arrive at the MRP. It's not just the cost of the phone itself; it's all the ancillary costs that contribute to its final price. Now, compare that to a packaged food item, like a bag of potato chips. The manufacturing cost includes the cost of the potatoes, the oil, and the seasonings. The packaging cost includes the bag itself and any labels or branding. The transportation cost covers shipping the chips from the factory to warehouses and then to grocery stores. The marketing cost includes advertising campaigns and in-store promotions.

Again, add the taxes and profit margins, and you get the MRP. Even for something as simple as a bag of chips, there are numerous factors that contribute to the final price. The key takeaway is that MRP calculation is not a one-size-fits-all process. It varies depending on the industry, the product, and the local market conditions. However, the basic principles remain the same: it's a combination of all the costs involved in producing, distributing, and selling a product, plus a profit margin for the manufacturer and retailer.

Understanding these examples provides insight. Every time you buy something, consider all the steps it took for it to reach you and how they contribute to the MRP. It can change how you value the item. It may even change your buying decisions, such as looking for sales and discounts!

How To Calculate Mr From Percentage Abundance

FAQ

6. Your Burning MRP Inquiries Answered

Still have some burning questions about MRP? Here are some frequently asked questions to help clear things up:

Q: Can a retailer sell a product for more than its MRP?

A: Absolutely not! Selling above the MRP is illegal in most places. The MRP is the maximum price that a retailer can charge.

Q: Does the MRP include taxes?

A: Yes, the MRP almost always includes all applicable taxes, such as VAT or GST.

Q: Can the MRP of a product change over time?

A: Yes, the MRP can change due to factors like changes in manufacturing costs, taxes, or market conditions. Manufacturers can revise the MRP and communicate it to retailers.

Q: Are online retailers also bound by MRP?

A: Yes, online retailers are also legally required to adhere to the MRP regulations. So, the price you see online should not exceed the MRP.